cxfcodegenplugin858.site News

News

Stock Broker Account Online

An online brokerage account allows you to easily transfer available funds between your Bank of America bank and Merrill investment accounts. Access Direct is an online, self-directed brokerage account which means you can do things like buy or sell mutual funds, ETFs, or other stock and help you. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. By Phone. Call By Mail. Zerodha - India's biggest stock broker offering the lowest, cheapest brokerage rates for futures and options, commodity trading, equity and mutual funds. A WellsTrade account offered by Wells Fargo Advisors opened online comes with Brokerage Cash Services, which give you convenient money-movement options. A brokerage account is a non-retirement investment account that lets you buy and sell securities like stocks, bonds, mutual funds and ETFs. You can deposit as. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. The top online brokerage accounts for trading stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers. An online brokerage account allows you to easily transfer available funds between your Bank of America bank and Merrill investment accounts. Access Direct is an online, self-directed brokerage account which means you can do things like buy or sell mutual funds, ETFs, or other stock and help you. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. By Phone. Call By Mail. Zerodha - India's biggest stock broker offering the lowest, cheapest brokerage rates for futures and options, commodity trading, equity and mutual funds. A WellsTrade account offered by Wells Fargo Advisors opened online comes with Brokerage Cash Services, which give you convenient money-movement options. A brokerage account is a non-retirement investment account that lets you buy and sell securities like stocks, bonds, mutual funds and ETFs. You can deposit as. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. The top online brokerage accounts for trading stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers.

A margin account allows you to borrow money from a brokerage firm to buy securities. This is also the only type of account in which investors can engage in. What we offer. Buy stocks, exchange traded funds (ETFs) and options online or with the TIAA mobile app for $0 per trade. Brokerage account. Investing and trading account. Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Learn. These types of accounts are designed to allow individuals to invest in the stock market Find the right one for you on our list of the best online brokerages. Open a brokerage account. Reasons to consider The Fidelity Account. Wide range of investment choices. $0 commission for online US stock, ETF, and option trades. Get up to $ Unlimited commission-free 1 online trades When you open and fund a JP Morgan Self-Directed Investing account (retirement or general) with. Online trading should be easy. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through. Bankrate analyzed dozens of brokerage firms to help you find the best online brokers for stocks. Here are our top picks for the best online stock brokers. A brokerage account gives you access to the stock market, allowing you to buy online brokers like Ally Invest. Brokers essentially act as middlemen. It's a great option if you want to invest in the stock market to work Pay no trade minimums, no account minimums and $0 online listed equity trades. Online trading of brokerage products--stocks, ETFs, CDs, and bonds--is simple in a Vanguard Brokerage Account. Here are the best online brokerage accounts and trading platforms with low costs and fees plus the best trading experience, mobile apps, and more. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan. Brokerage Plus. For clients who like flexibility when it comes to managing investments – plus the convenience of independent, online trading. Access. Start investing online with SoFi. Enjoy commission-free trades and access to stock trading, options, auto investing, IRAs, and more. Start with just $5. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Open a free Demat Account online with cxfcodegenplugin858.site and enjoy ₹ 0 brokerage for life on equity trading, mutual funds, and more. No demat account charges! Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Commission-free online trades apply to trading in U.S.-listed stocks, exchange-traded funds (ETFs) and options. Options trades are subject to a $ per-. Other fees and commissions apply to a WellsTrade account. Schedule subject to change at any time. 2Online Extended Hours Trading Risk Disclosures. 3Terms and.

Define Fha Loan

:max_bytes(150000):strip_icc()/FHAnew-V1-a128f12bf4584ae8a9a5b7d0214cd8e4.png)

The Federal Housing Administration (FHA) provides mortgage insurance on single-family, multifamily, manufactured home, and hospital loans. An FHA loan is a government-insured loan subject to certain qualifications and restrictions. FHA provides mortgage insurance on loans made by approved lenders. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, we'll pay a claim to the lender for the unpaid principal. What is an FHA loan? An FHA home loan is a mortgage that is insured by the Federal Housing Administration. These mortgages are backed by the United States. FHA-approved lenders can issue loans that are insured by the Federal Housing Administration and are ideal for buyers with low-to-moderate income. Conventional. FHA lenders will check the relationship between your monthly income and monthly debts. The restrictions can vary by lender, but your debt-to-income ratio should. The Federal Housing Administration (FHA) is a government agency that promotes affordable, easy-to-qualify-for home loans. The Basic FHA Insured Home Mortgage program can help individuals buy a single family home through a loan. An FHA home loan is a government-backed mortgage program that offers financial flexibility when buying a home. Learn about the benefits and requirements. The Federal Housing Administration (FHA) provides mortgage insurance on single-family, multifamily, manufactured home, and hospital loans. An FHA loan is a government-insured loan subject to certain qualifications and restrictions. FHA provides mortgage insurance on loans made by approved lenders. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, we'll pay a claim to the lender for the unpaid principal. What is an FHA loan? An FHA home loan is a mortgage that is insured by the Federal Housing Administration. These mortgages are backed by the United States. FHA-approved lenders can issue loans that are insured by the Federal Housing Administration and are ideal for buyers with low-to-moderate income. Conventional. FHA lenders will check the relationship between your monthly income and monthly debts. The restrictions can vary by lender, but your debt-to-income ratio should. The Federal Housing Administration (FHA) is a government agency that promotes affordable, easy-to-qualify-for home loans. The Basic FHA Insured Home Mortgage program can help individuals buy a single family home through a loan. An FHA home loan is a government-backed mortgage program that offers financial flexibility when buying a home. Learn about the benefits and requirements.

What is the FHA? The Federal Housing Administration is a government agency that was created to make it easier for Americans to become homeowners. It provides. What is the FHA? The Federal Housing Administration is a government agency that was created to make it easier for Americans to become homeowners. It provides. Question: What is RESPA? Answer: RESPA stands for the Real Estate Settlement Procedures Act. RESPA covers conventional mortgage loans on one-to-four family. An FHA loan is a government-backed loan that allows people to buy homes with a down payment as low as percent. The FHA is the only government agency that. FHA loans are insured by the government in order to help increase the availability of affordable housing in the U.S. These loans are backed by the FHA. Are you a first time home buyer? FHA Loans may the perfect opportunity to purchase a home with a low down payment. At the Federal Housing Administration (FHA), we provide mortgage insurance on loans made by FHA-approved lenders. In fact, we're one of the largest mortgage. The Federal Housing Administration (FHA) doesn't issue FHA loans. Instead, this agency insures FHA loans issued by FHA-approved private mortgage lenders, such. What is an FHA Loan? An FHA loan is a Government Backed Mortgage insured by the Federal Housing Administration (FHA). FHA loans require lower down payments. What's is the difference between an FHA loan and a conventional loan? A few things, actually. Mainly, FHA loans are backed by the Federal Housing Administration. What is an FHA loan? FHA-approved lenders. If a property owner defaults on their mortgage, the FHA will pay a claim to the lender for the unpaid principal. Federal Housing Administration (FHA) financing is issued by an FHA-approved lender that allows low-to-moderate-income borrowers a chance to secure a loan. These. An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). The FHA was created in as a result of the National Housing Act. This. FHA loans are mortgages insured by the Federal Housing Administration (FHA). Because they're government-backed, these mortgages have more flexible credit. They require a lower minimum down payment and a lower credit score than many conventional loans. FHA home loans are issued by FHA-approved lenders. What Is a. Federal Housing Administration (FHA). The Federal Housing Administration (FHA) - commonly referred to as HUD - issues loans that provide affordable mortgages to. FHA loans are loans from private lenders that are regulated and insured by the Federal Housing Administration (FHA), a government agency. An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender. Important FHA Guidelines for Borrowers. The FHA, or Federal Housing Administration, provides mortgage insurance on loans made by FHA-approved lenders. FHA.

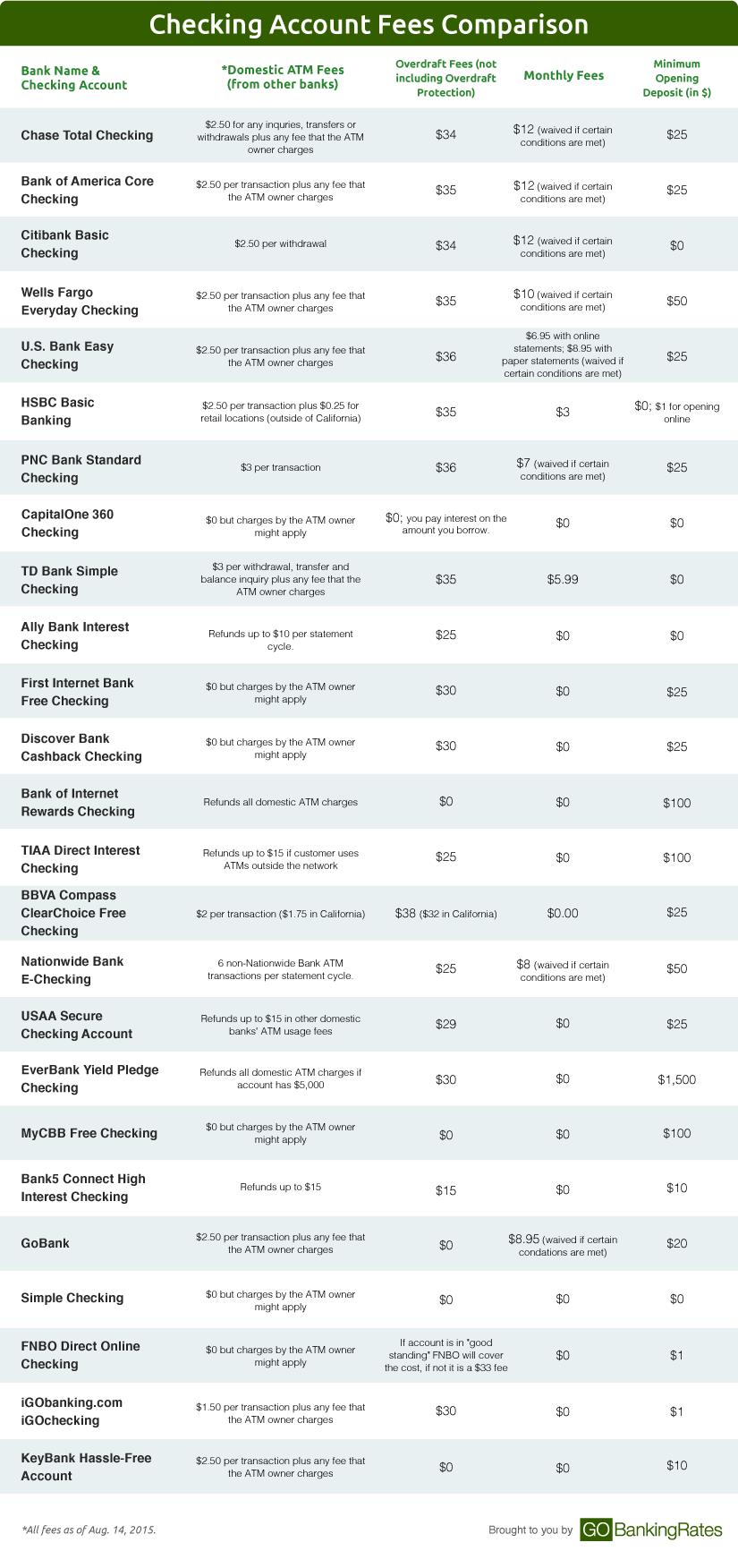

Online Checking Account Rates

Checkless account: · Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No. Umpqua Embark Checking ; Check, One Grow Savings account with monthly transfer ; Check, Up to $10 in ATM-Owner fee rebates per statement cycle ; X · Complimentary. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Must activate Online Banking and sign up for paperless statements to get free monthly paperless statement. Fee for other statement options waived for the first. Truist One Checking - a personal checking account with no overdraft fees + 5 ways to waive the monthly maintenance fee. Open your new checking account. Best high-yield checking accounts · Best for high APY: All America Bank Ultimate Rewards Checking · Best for large balances: Presidential Bank Advantage Checking. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. A simple solution for everyday banking. Overdraft. Get extra time to cover overdrafts with Citizens Peace of Mind®2. Monthly Maintenance Fee. A rate of % Annual Percentage Yield (APY) applies to accounts with balances between $0-$9,, $10,$24,, $25,$49,, $50,$. Checkless account: · Special offer: No monthly maintenance fee if you're ages · Monthly fee: $ No minimum daily balance requirement · Account perks: No. Umpqua Embark Checking ; Check, One Grow Savings account with monthly transfer ; Check, Up to $10 in ATM-Owner fee rebates per statement cycle ; X · Complimentary. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Must activate Online Banking and sign up for paperless statements to get free monthly paperless statement. Fee for other statement options waived for the first. Truist One Checking - a personal checking account with no overdraft fees + 5 ways to waive the monthly maintenance fee. Open your new checking account. Best high-yield checking accounts · Best for high APY: All America Bank Ultimate Rewards Checking · Best for large balances: Presidential Bank Advantage Checking. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. A simple solution for everyday banking. Overdraft. Get extra time to cover overdrafts with Citizens Peace of Mind®2. Monthly Maintenance Fee. A rate of % Annual Percentage Yield (APY) applies to accounts with balances between $0-$9,, $10,$24,, $25,$49,, $50,$.

Bank5 Connect is a smaller online bank, but offers competitive interest rates on the products it carries, including an impressive % APY on its checking. The % APY is guaranteed for the first 5 months after account opening. After the promotional period, the account will earn the posted interest rate of the. You do most of your banking online and prefer using a card instead of writing checks to make purchases. Fees and pricing. Monthly fee, Monthly fee. $8 with. Open a Performance Checking Account online with EverBank and get access to competitive checking interest rates and easy access to your money. We've analyzed over 40 options to bring you the best online checking accounts with competitive rates, rewards and perks. Which Account is Right For You? · No Minimum Balance · No Monthly Fees · Monthly Dividend · Non-GreenState ATM Fee Refunds · Cashback on Card Purchases 2 · 30,+. checking accounts online. Find the best Wells Fargo checking account for you The interest rate discount requires a qualifying Wells Fargo consumer checking or. Axos Bank Rewards Checking pays % APY on balances up to $50,—without imposing any monthly service fees or minimum requirements. Axos Bank Rewards. checking accounts online. Find the best Wells Fargo checking account for you The interest rate discount requires a qualifying Wells Fargo consumer checking or. Axos Bank offers a variety of checking accounts, including fee-free Essential Checking, interest-bearing Rewards Checking, and CashBack Checking. Earn a % APY2 —10X higher than the national rate Debit Card Rewards. Earn Membership Rewards. With no monthly service fees or overdraft fees, you'll have more money to invest. Travel with confidence. No foreign transaction fees. Just starting out? There is no monthly maintenance fee on our Advantage Safebalance Banking account if you're under age % APY* Serious Interest Checking® · $0 Monthly Maintenance Fee · $1, Minimum Deposit · Free w/eStatements ($5 Print Fee)** · Earns % APY* Interest on. A rate of % Annual Percentage Yield (APY) applies to accounts with balances between $0-$49,, $50,$99,, and $, or more. Advertised rates. Pay no account fees · Earn up to $ with direct deposit · Earn up to % APY · Access additional FDIC insurance up to $2M. See how our high-yield Online Savings Account rate stacks up. Compare Santander Checking Accounts ; Free Paperless Statements? Yes. Yes ; Paper Statement Fee. $0. $3 ; Mobile Banking and Online Banking? Yes. Yes ; Savings. High-yield checking account with no overdraft fees. Manage your money on the go without the hassle of sneaky fees or ATM scavenger hunts. According to national FDIC data from August 19, , the average checking account interest rate is %. This would translate to $7 in earnings on a $10,

Best Stock Tracking App For Beginners

2> Yahoo Finance: Yahoo Finance provides comprehensive stock tracking features, including customizable watchlists, interactive charts, and news. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Yahoo Finance is one of the best options out there for researching a ticker and tracking the basics of the market, especially for beginners. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Topping our list of best AI stock trading bots is Trade Ideas, which is an impressive stock trading software supported by an incredibly talented team. The booming popularity of commission-free trading apps like Robinhood (HOOD) has made stock trading more accessible than ever to new investors. With just a. Robinhood is best for beginner investors and active traders. Their platform is easy to use; there aren't a ton of extra bells and whistles to distract the user. Best Portfolio Tracking Apps · Seeking Alpha. Best overall, especially for comprehensive investment analysis. · Empower. Best for monitoring bank accounts and. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. 2> Yahoo Finance: Yahoo Finance provides comprehensive stock tracking features, including customizable watchlists, interactive charts, and news. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Yahoo Finance is one of the best options out there for researching a ticker and tracking the basics of the market, especially for beginners. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Topping our list of best AI stock trading bots is Trade Ideas, which is an impressive stock trading software supported by an incredibly talented team. The booming popularity of commission-free trading apps like Robinhood (HOOD) has made stock trading more accessible than ever to new investors. With just a. Robinhood is best for beginner investors and active traders. Their platform is easy to use; there aren't a ton of extra bells and whistles to distract the user. Best Portfolio Tracking Apps · Seeking Alpha. Best overall, especially for comprehensive investment analysis. · Empower. Best for monitoring bank accounts and. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance.

Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. The Best Free Stock Tracking Spreadsheet you'll find using Google Sheets. Simple and Easy to Use. Get it here and see how it works. Advanced portfolio tracking, investment analytics & reporting tools. Track performance, dividend income, currency gains & more. Get started now! 1) Monitor your stocks in a portfolio · 2) Track stock purchase by transactions · 3) Transactions compatible includes purchase, sale, dividend and stock splits · 4. The Yahoo Finance app offers comprehensive insights, news, real-time stock quotes, and more–all tailored for your personal stock portfolio. Make investing moves on the go · Trade US stocks, commission-free with no account fees or minimums for brokerage accounts · Create savings goals and track your. Track your spending, investments, and net worth in the best-in-class app for Mac and iPhone. Personal capital can be considered the most popular investment tracking app. It has million registered users, tracking over $ billion in assets. Kernel: Best App or Platform for Specialised Index Funds; Simplicity Investment Funds: Best App or Platform for Low-Cost Index Funds. Disclaimer: Interactive. Leading online stock portfolio tracker & reporting tool for investors Powerful portfolio tracking software that lets you check your investments in. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. Yahoo Finance - Stock Market 4+. Stocks, Business & Investing. Yahoo · #79 in Finance. A simple, efficient, andfree stock tracking appfor your inventory. Get all the essential inventory tracking features bundled in one FREE app. Create a custom stock game for your school or club! · Used by over 10, teachers and , students every year! · Includes student lessons and tutorials. Track all of your investments with the Investment Tracking App: Real Estate ✓ Stock market ✓ Forex ✓ Bonds ✓ Cryptocurrencies. This is the best and easiest digital investment tracking app I've ever used. · All you need to look after all of you crypto! · Best portfolio app, not just for. Beginner or intermediate stock and mutual fund investors need even Best investment apps help users to track the performance of their portfolio easily. Track your spending, investments, and net worth in the best-in-class app for Mac and iPhone. Best for Beginners: Groww. Groww is the perfect choice for novice investors looking to dip their toes into the stock market. Its user-friendly design and. Best Online Stock Brokers · Best Investment Apps · View All · Mortgages. Mortgages Learn More A Beginner's Guide to Investing in Stocks. How to start.

How To Apply For A Credit Limit Increase

The second way you may get a credit limit increase is if a credit card company increases your limit without a request from you. This typically occurs after you'. Having a lower total available credit without reducing your spending will drive your percentage ratio up. You can ask for a limit increase on another card or. Typically, credit accounts that have been open for more than three months are eligible for an increase. Applications are commonly restricted to one every six. Requesting (and being approved for) a credit limit increase is one way to quickly improve your utilization score, but it may count as a “hard” credit inquiry. How to Build or Improve Credit with a Credit Card · Apply For a Credit Card That Matches Your Spending Goals · Understand How Much of Your Available Credit You're. Contact your credit card provider. You can still get a credit limit increase even if you haven't been pre-approved. Just contact your credit card provider and. Request for a credit limit increase You could make the request online or over the phone by calling the customer service number on the back of your card. Keep. How do I increase my credit. Sign in to your online bank. · Click Overview, then select your credit card. · Click Increase my limit. · Follow the instructions. The second way you may get a credit limit increase is if a credit card company increases your limit without a request from you. This typically occurs after you'. Having a lower total available credit without reducing your spending will drive your percentage ratio up. You can ask for a limit increase on another card or. Typically, credit accounts that have been open for more than three months are eligible for an increase. Applications are commonly restricted to one every six. Requesting (and being approved for) a credit limit increase is one way to quickly improve your utilization score, but it may count as a “hard” credit inquiry. How to Build or Improve Credit with a Credit Card · Apply For a Credit Card That Matches Your Spending Goals · Understand How Much of Your Available Credit You're. Contact your credit card provider. You can still get a credit limit increase even if you haven't been pre-approved. Just contact your credit card provider and. Request for a credit limit increase You could make the request online or over the phone by calling the customer service number on the back of your card. Keep. How do I increase my credit. Sign in to your online bank. · Click Overview, then select your credit card. · Click Increase my limit. · Follow the instructions.

To request a credit limit increase, call your card issuer's customer service number (generally on the back of your card) or apply online. You will usually need. There are a few ways to get a credit limit increase: Use your card responsibly and just wait. Sometimes your card issuer will offer to increase your credit. There are two ways to request a credit line increase with Citi: online or over the phone. If Citi automatically grants you a credit increase (which it does. In order to be considered for a possible credit limit increase in the future, your income and mortgage or rent information must be fresh. We recommend updating. In the Capital One customer portal, for instance, there's a “Request Credit Line Increase” option — the prompt asks about your current income, the amount of. There are typically two types of credit limit increase letters you'll receive in the mail – one that says your credit limit has automatically increased, and. You can request a credit limit increase online, through the {Issuer Name} mobile app, or by calling customer service at the number on the back of your card. You can apply for an increase to your TD Credit Card in EasyWeb. After you login, your request will then be reviewed within 2 business days. First log into online banking at cxfcodegenplugin858.site Step 1: Select “Credit & Debit Cards” on the menu bar and then "Request a Credit Card Limit Increase”. Your bank may offer you a pre-approved credit limit increase if you have a history of making payments on time and using your credit responsibly. Enter your question in sentence form (eg, How do I contact Simplii Financial?). Don't include any confidential information, such as card or account numbers. To request a change to your credit limit, visit the Manage Accounts tab, click Payment and Credit Options and click Change Credit Limit. In order to be considered for a possible credit limit increase in the future, your income and mortgage or rent information must be fresh. We recommend updating. If you want to ask for a credit limit increase, it can typically be done in one of two ways: online or over the phone. Online requests can be done via your card. Browse American Express Customer Service to Learn How to Request a Credit Limit Increase on your Personal or Small Business Card. Learn More. Just goto Credit card. Scroll down where you see different options like "Make a payment", "Manage My Card", "Apple Pay Settting" and one of the. Otherwise, if you'd like an increase, you can contact your credit card company to request one. There are several actions you can take that will help you. Steps to sign up · Step 1: Log in to your account · Step 2: In the main navigation, click “Services.” · Step 3: Under “Account”, select the “Credit Limit Increase”. You can request a credit limit increase through online banking or in the HSBC U.S. Mobile Banking app. The easiest way to request a credit limit increase is. Once you're logged in, click your Credit Card Account and go to 'Account Details'. Click 'Request change' under 'Current Card limits', and you can make your.

Crypto Keys

Cryptocurrency uses a similar key-based security system. Instead of a jagged piece of specially cut metal, cryptocurrency keys are a string of numbers and. A recovery phrase is essentially a human-readable form of your crypto wallets' private keys and is usually displayed as a word phrase. A public key allows you to receive cryptocurrency transactions. It's a cryptographic code that's paired to a private key. While anyone can send transactions to. Cryptographic keys come in two fundamental types, symmetric and asymmetric, and have various properties such as length and crypto-period that depend on their. Throughout this blog post, we will highlight the differences and clarify the importance of crypto keys whether public or private. A private key is an encrypted alphanumeric code that permits access to your bitcoin or cryptocurrency holdings. It is the only true way of proving that you. Every crypto wallet consists of a unique pair of public and private keys. There is a one-way-relationship between private and public key: through means of. We hold the private keys, just like Coinbase and the majority of the exchanges. Even though you might not hold your private keys, your data and assets are. In cryptocurrencies, there are two key types to make note of: private keys and public keys. Private keys are used to control access to digital assets, and must. Cryptocurrency uses a similar key-based security system. Instead of a jagged piece of specially cut metal, cryptocurrency keys are a string of numbers and. A recovery phrase is essentially a human-readable form of your crypto wallets' private keys and is usually displayed as a word phrase. A public key allows you to receive cryptocurrency transactions. It's a cryptographic code that's paired to a private key. While anyone can send transactions to. Cryptographic keys come in two fundamental types, symmetric and asymmetric, and have various properties such as length and crypto-period that depend on their. Throughout this blog post, we will highlight the differences and clarify the importance of crypto keys whether public or private. A private key is an encrypted alphanumeric code that permits access to your bitcoin or cryptocurrency holdings. It is the only true way of proving that you. Every crypto wallet consists of a unique pair of public and private keys. There is a one-way-relationship between private and public key: through means of. We hold the private keys, just like Coinbase and the majority of the exchanges. Even though you might not hold your private keys, your data and assets are. In cryptocurrencies, there are two key types to make note of: private keys and public keys. Private keys are used to control access to digital assets, and must.

The Simple Key Loader (SKL) is an advanced secure cryptographic device, enabling safe distribution and storage of communication security (COMSEC) keys. A good place to start thinking about keys and addresses within crypto, is by thinking about their function in relation to where you live. A cryptographic key. In this document, keys generally refer to public key cryptography key pairs used for authentication of users and/or machines (using digital. At IRA Financial, we allow you to hold your private keys. Keep reading to learn how you can benefit from our Self-Directed IRA solution. A value used to control cryptographic operations, such as decryption, encryption, signature generation, or signature verification. The most secure way to hold your crypto, a hardware wallet is a physical device that stores your keys offline while still allowing easy and safe signing. Imagine cryptographic keys as unique, long codes that work together as digital locks and keys. Every user on the blockchain network has a pair of keys. The foundation of this security lies in understanding the secrets of the crypto private keys and implementing effective strategies to protect them. Private Key/Secret Key definition: A cryptographic key used to access and control cryptocurrency wallets, providing ownership and security of digital. Keys Token Price Summaries. Latest Data. Keys Token's price today is US$, with a hour trading volume of $N/A. KEYS is % in the last 24 hours. It's important to secure sensitive account information, such as private keys, since losing them could mean losing all your crypto funds. Public-key cryptography, or asymmetric cryptography, is the field of cryptographic systems that use pairs of related keys. Each key pair consists of a public. A cryptocurrency wallet is a software program that stores your cryptocurrency keys and lets you access your coins. Discover how crypto wallets work. In cryptography, a public key and private key are both needed to access any encrypted information. In essence, cryptography is the practice of encrypting. The public/private key pair used to send and receive cryptocurrencies. The public key can be published anywhere like a bank account number to receive crypto. Key management is the set of protections that you use to store and protect your crypto keys from theft and loss. Crypto addresses and keys are the security framework for how your personal assets are managed, stored, and moved on the blockchain. Private keys are a crucial part of how crypto works. Every crypto address has a corresponding private key, which controls access to crypto. Generate a general purpose RSA key pair for signing and encryption. I am getting confused between these 3, when to use/specify what keyword while generating. Explore all possible Bitcoin, Ethereum, Litecoin, Dogecoin Keys in decimal, hex or WIF format.

What Are Unicorn Companies

What is Unicorn A "unicorn" is a privately-owned startup business worth more than $1 billion. In venture capital companies, the term unicorn is often used. A unicorn startup or unicorn company is a private company with a valuation over $1 billion USD priced via a venture funding round. Unicorns are 'startups. In business, a unicorn is a startup company valued at over US$1 billion which is privately owned and not listed on a share market. The term was first. Unicorns – startups that pass a $1B valuation – can act as a short-hand for success for founders, investors and startup ecosystems. These days unicorns are not. Travel & Mobility Tech's unicorn list contains a complete list of all privately-held companies with a company valuation of at least 1 billion US dollars. PitchBook's unicorn tracker contains all new unicorn companies formed since the beginning of Explore trends in unicorn formation by filtering the. A unicorn company is a privately held company that's valued at $1 billion or more. Which valuations are used to rank the unicorn companies on this board? A $1B “valuation” (a word we'll explain in a moment) elevates a private company to the status of “Unicorn” - the mythical animal, endlessly sought but never. Key Points · Unicorn companies are start-ups valued at over $1 billion. · Disruptive innovation, bringing unique products to market first, and rapid growth. What is Unicorn A "unicorn" is a privately-owned startup business worth more than $1 billion. In venture capital companies, the term unicorn is often used. A unicorn startup or unicorn company is a private company with a valuation over $1 billion USD priced via a venture funding round. Unicorns are 'startups. In business, a unicorn is a startup company valued at over US$1 billion which is privately owned and not listed on a share market. The term was first. Unicorns – startups that pass a $1B valuation – can act as a short-hand for success for founders, investors and startup ecosystems. These days unicorns are not. Travel & Mobility Tech's unicorn list contains a complete list of all privately-held companies with a company valuation of at least 1 billion US dollars. PitchBook's unicorn tracker contains all new unicorn companies formed since the beginning of Explore trends in unicorn formation by filtering the. A unicorn company is a privately held company that's valued at $1 billion or more. Which valuations are used to rank the unicorn companies on this board? A $1B “valuation” (a word we'll explain in a moment) elevates a private company to the status of “Unicorn” - the mythical animal, endlessly sought but never. Key Points · Unicorn companies are start-ups valued at over $1 billion. · Disruptive innovation, bringing unique products to market first, and rapid growth.

90% of unicorn companies are set to either run out of steam or simply fail. There's many reasons for this, from unit economics to a glut of investors. In venture capital, a Unicorn is a privately-held tech company valued at more than $1 billion. The term was coined in by Aileen Lee, the founder of Cowboy. The Global Unicorn Report. A unicorn startup is a private company valued over $1 billion. Venture capitalist Aileen Lee coined the term “unicorn startup”. Unicorn: A unicorn company is any private company that is valued at $1-Billion or more and is Venture Capital funded. ^ Graduated Unicorn: A startup that. Unicorn companies are those that reach a valuation of $1 billion without being listed on the stock market and are the dream of any tech startup. What factors. A Unicorn is generally seen to be a startup that in a relatively short time (5 years or less) achieves $1 billion in sales. In finance, “unicorn” is a term that describes a privately-owned startup with a valuation of over $1 billion. The term was introduced by venture capital. This program is designed to help business leaders and entrepreneurs unravel the mysteries of unicorn success and what it really takes to scale businesses to. In , the global landscape of startup companies known as unicorns, valued at over one billion US dollars, has grown to 1,, a slight increase from. What are unicorn companies? Unicorn companies are defined as startups that reach a valuation of $1 billion and are not listed on the stock market. The number of. A unicorn company or startup is a title given to a privately owned company valued at over $1 billion (£ million). The answer is yes. Unicorn is a term given only to startups having a billion-dollar valuation. Startups that exceed the valuation of USD 10 billion are grouped. A unicorn startup or unicorn company is a private company with a valuation over $1 billion USD. Unicorns are 'startups', i.e they do not include post-exit. The United States and China dominate the unicorn landscape, with and unicorns, respectively. These two countries have established themselves as major. In finance, a unicorn is a privately held startup company with a current valuation of US$1 billion or more. Notable lists of unicorn companies are maintained by. See Fortune's list of "unicorns"—private startup companies that have soared to a $1 billion valuation or higher, based on fundraising. How Unicorn Companies Maintain Their Growth Momentum · 1. Align the New Team Around a Unified Messaging Framework · 2. Streamline Your Selling Processes · 3. A unicorn company is a private company with a valuation of at least $1 billion. Many current and recent unicorns are tech startups located in the Silicon. A unicorn company is a startup with a valuation of more than $1 billion. Uber and Airbnb are examples of startups that today are worth more than $1 billion.

Questions To Ask A Money Manager

Here are my questions to cut through the noise, ensuring you'll leave your next investment provider meeting feeling informed, confident, and with a deeper. Have a money question? Ask your question and get answers from financial advisors in the Wealthtender community. Here are five key questions to ask financial advisors to see if they're really the right fit for your needs. Asking about the values of a financial advisor or firm gives you insight into their approach to client relationships and financial planning. That way, you can. Ask these questions to find out if you're talking to the right person. The questions below can get you started, and the explanations provide context answers. By asking these ten crucial questions, you can gain a better understanding of your advisor's qualifications, services, costs, and expectations for your working. Here are 20 vital questions to ask when considering a financial advisory firm or assessing your current one. 7 questions every advisor should be able to answer. Whatever your priorities, this can help you find someone who understands you and has the resources to help. Below are issues you will want to explore before you hire someone to be your financial advisor. You can ask these questions at your first meeting or send them. Here are my questions to cut through the noise, ensuring you'll leave your next investment provider meeting feeling informed, confident, and with a deeper. Have a money question? Ask your question and get answers from financial advisors in the Wealthtender community. Here are five key questions to ask financial advisors to see if they're really the right fit for your needs. Asking about the values of a financial advisor or firm gives you insight into their approach to client relationships and financial planning. That way, you can. Ask these questions to find out if you're talking to the right person. The questions below can get you started, and the explanations provide context answers. By asking these ten crucial questions, you can gain a better understanding of your advisor's qualifications, services, costs, and expectations for your working. Here are 20 vital questions to ask when considering a financial advisory firm or assessing your current one. 7 questions every advisor should be able to answer. Whatever your priorities, this can help you find someone who understands you and has the resources to help. Below are issues you will want to explore before you hire someone to be your financial advisor. You can ask these questions at your first meeting or send them.

We've put together eight specific questions to ask a financial advisor before working with one. #1 Is there a minimum asset amount required to work with you? We sat down with Misty Lynch, John Hancock's Head of Financial Planning to come up with a list of 8 questions you should ask before you team up with an FA. 7 Essential Questions to Ask A Financial Advisor in · Are you a fiduciary? · How do you get paid? · How will we work together? · What are all associated. Questions to ask a financial adviser · 1. How will you make sure my money lasts as long as I need it? · 2. How can you help me to maximise my Age Pension. We've outlined the key questions for you below, but it will also be important for you to make sure that you get a good sense from the financial advisor you are. We have put together a list of questions to ask financial advisors. These questions will improve your conversations with any advisor you meet and might even. Here are seven essential questions you should ask a financial advisor. Whether you're starting to work with an advisor, or still searching for the right person. We lay out 8 questions to help you get a better understanding of who your advisor is, what motivates them, and whether or not they are the right fit for your. Key questions to ask your financial adviser · What's in this guide · What do you charge and how much am I likely to pay? · What services do you offer? · If you're. 1. What Services Do You Offer? What Services Do You Offer. Before meeting a wealth manager or a financial advisor, it's. By asking these ten crucial questions, you can gain a better understanding of your advisor's qualifications, services, costs, and expectations for your working. Here are five questions you need to ask fund managers. 1. What's your experience and how well is that experience documented? 15 Questions to Ask When Choosing a Financial Advisor · Question #1: Are you a fiduciary advisor in all our engagements (and will you agree to this in writing)?. In this blog post, you will learn the key questions to ask a financial advisor so you can get the most out of your relationship and ensure you're getting the. It can be tough to know where to start when looking for a financial advisor. Here are the key questions to ask a potential advisor. 1. Are you a fiduciary at all times? This is a foundational question: Is the advisor always a fiduciary? In other words, does the advisor always have your best. I've prepared a list of key questions to help you narrow down the good from the bad and make an informed decision about who you'll want to hire. 1. Are you a fiduciary % of the time? Our answer: We are a fiduciary % of the time. Why it's important: A fiduciary financial advisor is legally required. Here are my questions to cut through the noise, ensuring you'll leave your next investment provider meeting feeling informed, confident, and with a deeper.

Systematics Banking Software

Find the top Global Retail Core Banking Software with Gartner. Compare and filter by verified product reviews and choose the software that's right for your. Description. FIS Global Systematics (now Fidelity National Information Services (FIS)) is a core banking suite designed for the financial and banking. 67 companies use FIS Global Systematics. FIS Global Systematics is most often used by companies with > employees & $>M in revenue. Whether you are a growing de novo bank, a large, multinational financial institution or a non-traditional banking organization, Fiserv has a bank platform that. application (Impacs, RM/CIS or GN/TS) batch and CICS; At least 1 years of relevant core banking application experience (Systematics); Experience with database. Banking Technology Services. Helping banks of all sizes improve their technology. Because no bank Systematics is the name of a retail banking software product. Discover companies using FIS Global Systematics by locations, employees, revenue, industries, and more. Compare your target to your CRM or marketing platform. Our history goes back to over 50 years ago to the founding of Systematics, Inc., the pioneer of outsourcing data processing for banks. FIS®' core banking solutions gives the tools to streamline business processes. Easily upgrade your bank's legacy core to the future of banking. Find the top Global Retail Core Banking Software with Gartner. Compare and filter by verified product reviews and choose the software that's right for your. Description. FIS Global Systematics (now Fidelity National Information Services (FIS)) is a core banking suite designed for the financial and banking. 67 companies use FIS Global Systematics. FIS Global Systematics is most often used by companies with > employees & $>M in revenue. Whether you are a growing de novo bank, a large, multinational financial institution or a non-traditional banking organization, Fiserv has a bank platform that. application (Impacs, RM/CIS or GN/TS) batch and CICS; At least 1 years of relevant core banking application experience (Systematics); Experience with database. Banking Technology Services. Helping banks of all sizes improve their technology. Because no bank Systematics is the name of a retail banking software product. Discover companies using FIS Global Systematics by locations, employees, revenue, industries, and more. Compare your target to your CRM or marketing platform. Our history goes back to over 50 years ago to the founding of Systematics, Inc., the pioneer of outsourcing data processing for banks. FIS®' core banking solutions gives the tools to streamline business processes. Easily upgrade your bank's legacy core to the future of banking.

W2 Contract- Long Term Remote Positions- Systematics Business Analyst*04 · BUSINESS ANALYST WITH SYSTEMATICS AND RM · Business Systems Analyst with Systematics. Gartner has recognized Oracle as a top core banking platform provider, with its complete retail banking solution suite that provides next-evolution capabilities. The company's two founders are Elizabeth Glasbrenner and Vance Smiley; their father, Walter Smiley, founded Systematics. Media. Videos. Core Banking Software. Capital One is a nationally recognized and high-tech business banking company, offering better customized consumer and commercial lending and deposit financial. Transforming your ideas into software, in no time. The N5 Software Factory was born from the needs of the financial industry and is now available for everyone. The World Bank upgraded STEP, its procurement complaints system, with a new Contract Management Module. COBIS Core Banking | COBIS UBS (universal banking solution). 10, Core BankVision. 11, Corebank, FIS Alltel Systematics, Sanchez Profile, Horizon ACBS (Advanced. Fidelity Information Systems (FIS) still uses the name 'Systematics' as the name of a retail banking software product suite. I'd start with. Systematics Financial Services Inc. FIS offers a wide range of products and services for the financial industry, including core banking systems, payment. Systematics was a leading provider of financial software and services for the banking industry worldwide. Systematics was consistently ranked by Forbes. Discover companies using FIS Global Systematics by locations, employees, revenue, industries, and more. Compare your target to your CRM or marketing platform. solution for retail and commercial financial organizations. Product details · Feature-rich and flexible. Systematics Core Banking System. Modernize your. Systematics is a suite of retail and commercial banking applications focused L) is a financial services software provider offering solutions for banking. From that realization sprang Systematics, founded in Little Rock in , and recognized today as an early pioneer in technology-driven finance. Far from being. Systematics for a time, establishing their midrange banking solution. Systems was providing ATM software to a bank that used Grant County Bank software. Systematics (Legacy), eCAS2 (Legacy), Integrated Banking Solution, HORIZON, FIS Modern Banking Platform. Earn a $25 Gift Card (Limited-Time Only). Share your. Mainframe Developer (with FIS Systematics Core Banking) % REMOTE systems and product solutions, applying expert knowledge of engineering principles. A core banking system is the software that banks use to manage their most critical processes, such as customer accounts, transactions and risk management. • Name of primary core banking solutions: IBS, Horizon, Profile, and Systematics. • Target customer base: All banks and credit unions. • Number of U.S.-based. Systematic was established in , and has since grown to become an international IT company that focuses on six core business software solutions on time.

Refinance Mortgage Rate Calculator With Taxes And Insurance

Use this calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your estimated. Our mortgage payment calculator estimates your total monthly mortgage payment, including: Principal, Interest, Property taxes, Homeowners insurance, and HOA. Refinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. Our refinance calculator has a preset interest rate. To estimate your new loan payment, enter today's current mortgage rate into our refinancing calculator. Use this calculator to estimate how much it will cost you to refinance your home loan Taxes & Insurance. Property tax (yearly)? Must be between $0 and. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Actual payments will be greater with taxes and insurance. This calculator is for homeowners who are looking to make a strictly economic decision in terms of which loan will be better based upon comparing the interest. Use this refinance calculator to see if refinancing your mortgage is right for you. Calculate estimated monthly payments and rate options for a variety of. Use this calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your estimated. Our mortgage payment calculator estimates your total monthly mortgage payment, including: Principal, Interest, Property taxes, Homeowners insurance, and HOA. Refinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. Our refinance calculator has a preset interest rate. To estimate your new loan payment, enter today's current mortgage rate into our refinancing calculator. Use this calculator to estimate how much it will cost you to refinance your home loan Taxes & Insurance. Property tax (yearly)? Must be between $0 and. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Actual payments will be greater with taxes and insurance. This calculator is for homeowners who are looking to make a strictly economic decision in terms of which loan will be better based upon comparing the interest. Use this refinance calculator to see if refinancing your mortgage is right for you. Calculate estimated monthly payments and rate options for a variety of.

Looking to refinance your mortgage? Use our mortgage refinance calculator to estimate your new mortgage terms, loan amount, and interest rates. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Increasing your down payment and decreasing your interest rate and mortgage term length will make your monthly payment go down. Taxes, insurance, and HOA fees. Ready to see how much you can save on your monthly mortgage with a refinance? Use our free calculators to run the numbers. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out. Home Mortgage refinance calculator to estimate your monthly mortgage payments, with taxes and insurance based on the home's appraised value. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. How to calculate monthly mortgage payments? Your monthly mortgage payment includes loan principal and interest, property taxes, homeowners insurance, and. Take the guesswork out of getting a mortgage with this simple mortgage calculator mortgage payment, including principal, interest, taxes, and insurance. Free calculator to plan the refinancing of loans by comparing existing and refinanced loans side by side, with options for cash out, mortgage points. Interested in refinancing to a lower rate or lower monthly payment? With NerdWallet's free refinance calculator, you can calculate your new monthly payment. Estimate your monthly mortgage payments with taxes and insurance by using our free mortgage payment calculator from U.S. Bank. Your current payment is the sum of principal, interest and PMI (Principal Mortgage Insurance). Because refinancing does not affect your insurance or taxes, they. Your total estimated refinancing costs will be: $6, · Loan Info · Choose a term length · Taxes & Insurance · Origination Fees · Other Settlement Services. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. monthly payments for your new home. This free mortgage tool includes principal and interest, plus estimated taxes, insurance, PMI and current mortgage rates. You'll also need to share your credit score range, your estimated cash-out amount, your loan term and your estimated mortgage interest rate. You can use. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Mortgage Calculator ; Loan Term? years ; Interest Rate? ; Start Date ; Include Taxes & Costs Below ; Annual Tax & Cost. Property Taxes? · Home Insurance? · PMI.